Mars, Incorporated, a family-owned, global leader in pet care, snacking and food and Kellanova (NYSE: K), a leader in global snacking, international cereal and noodles and North America frozen foods, announced that Mars has received unconditional approval from the European Commission for its pending acquisition of Kellanova. As a result, all required regulatory approvals and clearances for the pending transaction have been obtained.

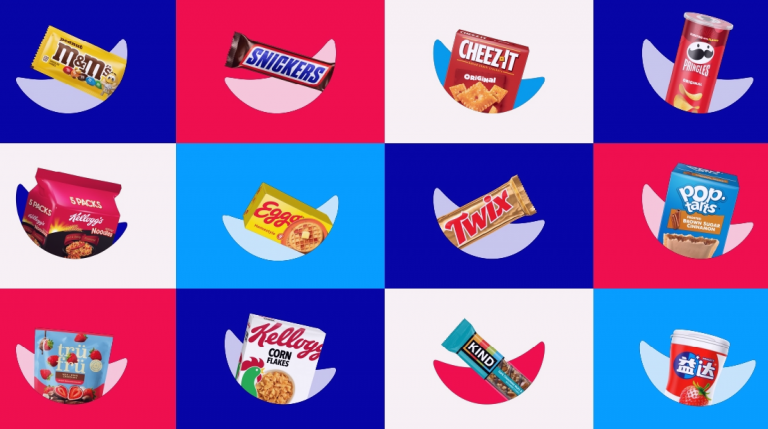

Mars and Kellanova anticipate closing the pending transaction on December 11, 2025, subject to the satisfaction or waiver of customary closing conditions. Upon close, Kellanova’s portfolio of snacking brands, which includes Pringles®, Cheez-It®, Pop-Tarts®, Rice Krispies Treats®, RXBAR® and Kellogg’s international cereal brands, will join the existing Mars Snacking portfolio, which includes beloved brands like SNICKERS®, M&M’S®, TWIX®, SKITTLES®, EXTRA® and KIND®.

Following the close of the pending transaction, Mars expects the combined Snacking business to generate around $36 billion in annual revenues, with a portfolio that includes 9 billion-dollar brands. Mars Snacking will continue to be headquartered in Chicago, IL and will operate in more than 145 markets, serving millions of consumers. Powered by a team of more than 50,000 Associates, it will operate 80 global production facilities and more than 170 retail outlets like Hotel Chocolat and M&M’S World.

“We are excited to have received final regulatory approval for the pending acquisition of Kellanova,” said Poul Weihrauch, CEO and Office of the President of Mars, Incorporated. “Our focus now turns to welcoming Kellanova employees to Mars and creating an even more innovative global snacking business that delivers greater choice and quality to more consumers around the world.”

“Today marks an extraordinary milestone and the culmination of years of work for many of our Associates,” said Andrew Clarke, Global President of Mars Snacking. “We can’t wait to welcome Kellanova talent to Mars and create a shared, global snacking leader with a beloved range of brands. We’ve said all along that Mars Snacking and Kellanova will be better together, building on the strength of our respective legacies and capabilities to unlock new possibilities and drive growth.”

Steve Cahillane, Chairman, President and CEO of Kellanova, said, “This combination will bring together two purpose-driven and principles-led companies. Serving as Kellanova’s Chairman, President and CEO has been a true honor, and I’m looking forward to seeing Kellanova people and brands thrive as part of Mars Snacking.” The parties announced on August 14, 2024, that they had entered into a definitive agreement under which Mars agreed to acquire Kellanova. The pending transaction received Kellanova shareowner approval on November 1, 2024. The pending merger received the final of all 28 required regulatory approvals and clearances on December 8, 2025. Following the completion of the pending transaction, which remains subject to customary closing conditions, Kellanova’s common stock will be delisted and will cease trading on the New York Stock Exchange.

For more news like this, click here.